Credit Approval#

This chapter explains the development of a custom deep learning model aimed at optimizing credit decisions for a financial institution. The primary objective of this model is to predict credit-related outcomes like approval status, credit limit, interest rate, and default risk. Furthermore, we aim to maximize profits while managing risks. This requires careful design of a custom loss function that balances profitability and credit risk.

Let’s break down the process.

Understanding the Problem#

Business Objectives

The institution wants to:

Approve credit for customers: Decide which customers should receive credit.

Set credit limits: Decide the maximum amount of credit for approved customers.

Assign interest rates: Set a suitable interest rate based on the customer’s risk profile.

Predict default risks: Estimate the probability that a customer might default on their credit.

Optimize profits: Use the model to maximize profit by accurately predicting the right credit terms and avoiding high-risk customers. The institution profits by charging interest on approved credit, but it incurs losses when customers default on their payments. Therefore, optimizing profits requires balancing between generating interest (revenue) and avoiding defaults (costs).

The institution profits by charging interest on approved credit, but it incurs losses when customers default on their payments. Therefore, optimizing profits requires balancing between generating interest (revenue) and avoiding defaults (costs).

Data Simulation#

We created synthetic data to simulate customer behavior and credit-related factors. The dataset includes variables such as whether the customer was approved for credit, the credit limit they received, the interest rate applied, whether they defaulted, and the utilization rate (the proportion of the credit limit that the customer uses).

Here’s a look at the data preparation:

import numpy as np

import pandas as pd

from sklearn.preprocessing import StandardScaler

# Set the seed for reproducibility

np.random.seed(42)

# Generating synthetic data

num_samples = 1000

X = np.random.rand(

num_samples, 2

) # Customer features (e.g., telecom data, demographics)

y_approved = np.random.randint(0, 2, size=(num_samples, 1)) # Approval status

y_credit_limit = (

np.random.rand(num_samples, 1) * (100000 - 10000) + 10000

) # Credit limit between 10,000 to 100,000

y_interest_rate = (

np.random.rand(num_samples, 1) * (0.60 - 0.22) + 0.22

) # Interest rate from 22% to 60%

y_defaulted = np.random.randint(0, 2, size=(num_samples, 1)) # Default status (0 or 1)

y_repayment = 1 - y_defaulted # Repayment probability (inverse of default)

y_utilization_rate = np.random.rand(num_samples, 1) # Credit utilization rate (0 to 1)

# Profit calculation based on observed data (for approved customers)

y_profit = y_approved * (

(y_credit_limit * y_interest_rate * y_utilization_rate * y_repayment)

- (y_credit_limit * y_defaulted)

)

observed = pd.DataFrame(

{

"Approved": y_approved.flatten(),

"Credit_Limit": y_credit_limit.flatten(),

"Interest_Rate": y_interest_rate.flatten(),

"Defaulted": y_defaulted.flatten(),

"Repayment_Prob": y_repayment.flatten(),

"Utilization_Rate": y_utilization_rate.flatten(),

"Profit": y_profit.flatten(),

}

)

# Scale the input data for better convergence

scaler = StandardScaler()

X_scaled = scaler.fit_transform(X)

Key Variables

Customer features (X): These are random values representing two customer characteristics (such as demographics or telecom data).

y_approved: Binary variable (0 or 1) indicating whether the customer was approved for credit.y_credit_limit: The amount of credit granted to the customer, ranging between 10,000 and 100,000.y_interest_rate: The interest rate charged to the customer, which ranges from 22% to 60%.y_defaulted: Binary variable (0 or 1) indicating whether the customer defaulted on their credit.y_repayment: The repayment probability, calculated as the inverse of the default status (i.e., 1 - y_defaulted).y_utilization_rate: A random number between 0 and 1, representing the proportion of the credit limit that the customer actually uses.

Profit Calculation

Profit is calculated only for customers who were approved for credit. It is computed as:

Profit= (Credit Limit x Interest Rate x Utilization Rate x Repayment Probability) − (Credit Limit x Defaulted)

This equation reflects that profit depends on:

How much of the credit limit is utilized by the customer (utilization rate).

The interest charged on that utilization.

The repayment probability (since profit is lost if the customer defaults).

Model Architecture#

Output Layers for Different Predictions#

We create specific output layers for each prediction task:

from tensorflow.keras.layers import Input, Dense, Concatenate

approval_output = Dense(1, activation="sigmoid", name="approved")(

shared

) # Predict approval

credit_limit_output = Dense(1, activation="linear", name="creditlimit")(

shared

) # Predict credit limit

interest_rate_output = Dense(1, activation="linear", name="interestrate")(

shared

) # Predict interest rate

default_risk_output = Dense(1, activation="sigmoid", name="defaultrisk")(

shared

) # Predict default risk

repayment_output = Dense(1, activation="sigmoid", name="repayment")(

shared

) # Predict repayment probability

utilization_rate_output = Dense(1, activation="sigmoid", name="utilizationrate")(

shared

) # Predict utilization rate

# Concatenate predicted outputs for custom loss

predicted_values_task1 = Concatenate()(

[

approval_output,

credit_limit_output,

interest_rate_output,

default_risk_output,

repayment_output,

utilization_rate_output,

]

)

Approval prediction (

approval_output): Uses a sigmoid activation because it’s a binary classification problem (approve or not).Credit limit prediction (

credit_limit_output): Uses a linear activation because the credit limit is a continuous variable.Interest rate prediction (

interest_rate_output): Similarly, uses linear activation for flexibility in predicting continuous values.Default risk prediction (

default_risk_output) and repayment prediction (repayment_output): These use sigmoid activation since they are probabilities.Utilization rate prediction (

utilization_rate_output): Predicts a value between 0 and 1, which is the proportion of the credit limit that the customer uses.

Custom Loss Function for Profit Optimization#

The core of this algorithm lies in optimizing profit while managing risk. We define a custom loss function that helps us maximize profit. This function factors in both the revenue (from interest) and the cost (from defaults). The overall goal is to maximize the difference between revenue and cost, which equates to maximizing profit.

Average Daily Balance (ADB):

Avg Daily Balance = Pred Credit Limit x Pred Utilization Rate

Daily Interest Rate:

daily_interest_rate = pred_interest_rate / 365

Interest Calculation:

interest = avg_daily_balance * daily_interest_rate * days_in_lookahead

Revenue:

revenue = interest * repayment_prob

Cost:

cost = credit_limit * default_risk

Profit: revenue - cost`text{cost} $$

Breakdown of the Loss Function#

import tensorflow as tf

# User-defined parameters for constraints

lookahead_months = 6 # Example: looking ahead 6 months

days_in_lookahead = lookahead_months * 30 # Approximate number of days in the lookahead period

max_credit_limit = 100000 # Maximum credit limit

min_credit_limit = 10000 # Minimum credit limit

max_interest_rate = 0.6 # Maximum interest rate

min_interest_rate = 0.22 # Minimum interest rate

def task1_custom_loss(y_true, y_pred):

# Ground truth values

true_approved = y_true[:, 0]

true_credit_limit = y_true[:, 1]

true_interest_rate = y_true[:, 2]

true_defaulted = y_true[:, 3]

true_repayment = y_true[:, 4]

true_utilization_rate = y_true[:, 5]

# Predictions

pred_approval_prob = y_pred[:, 0]

pred_credit_limit = tf.minimum(tf.maximum(y_pred[:, 1], min_credit_limit), max_credit_limit)

pred_interest_rate = tf.minimum(tf.maximum(y_pred[:, 2], min_interest_rate), max_interest_rate)

pred_default_risk = y_pred[:, 3]

pred_repayment = y_pred[:, 4]

pred_utilization_rate = tf.clip_by_value(y_pred[:, 5], 0, 1)

# Calculate Average Daily Balance (ADB)

avg_daily_balance = pred_credit_limit * pred_utilization_rate

# Calculate daily interest rate

daily_interest_rate = pred_interest_rate / 365

# Revenue is interest payments over the lookahead period

interest = avg_daily_balance * daily_interest_rate * days_in_lookahead

revenue = interest * pred_repayment # Revenue from interest scaled by repayment probability

# Cost from defaults

cost = pred_credit_limit * pred_default_risk

# Profit is calculated only for approved customers

approved_numeric = tf.cast(pred_approval_prob >= 0.5, tf.float32)

profit = approved_numeric * (revenue - cost)

# We want to maximize profit, so return negative profit as loss

return -tf.reduce_mean(profit)

Explanation#

Predictions: The model predicts approval probability, credit limit, interest rate, default risk, repayment probability, and utilization rate. We ensure that the predicted values respect practical constraints (e.g., credit limits are within a predefined range).

Average Daily Balance (ADB): This is calculated by multiplying the predicted credit limit with the predicted utilization rate. It reflects the amount of credit that a customer uses on average daily.

Daily Interest Rate: The predicted interest rate is divided by 365 to convert it into a daily rate.

Revenue: The revenue is the interest earned on the ADB over a period of time (defined by

days_in_lookahead), scaled by the predicted repayment probability.Cost: The cost is the amount lost when a customer defaults, calculated as the credit limit multiplied by the predicted default risk.

Profit: Profit is the difference between revenue and cost, but we only consider it for approved customers (i.e., those with an approval probability above 0.5).

Loss: Since we want to maximize profit, we return the negative of the average profit as the loss function.

Model Compilation and Training#

We compile the model using the custom loss function, and then we train it on the scaled data.

model_task1 = Model(inputs=input_layer, outputs=predicted_values_task1)

model_task1.compile(

optimizer=tf.keras.optimizers.Adam(learning_rate=0.01), loss=task1_custom_loss

)

# Prepare the training data

y_train = np.concatenate(

[

y_approved,

y_credit_limit,

y_interest_rate,

y_defaulted,

y_repayment,

y_utilization_rate,

],

axis=1,

)

# Train the model

history_task1 = model_task1.fit(

X_scaled, y_train, epochs=100, batch_size=32, validation_split=0.2, verbose=0

)

The training process optimizes the model parameters to maximize profit by balancing revenue generation and risk minimization.

Model Evaluation#

Prediction and Counterfactual Analysis#

Once the model is trained, we use it to make predictions for credit approval, credit limits, interest rates, and other variables. We can then calculate the predicted profit and compare it with the actual observed profit to evaluate the model’s performance.

# Predictions

pred_task1 = model_task1.predict(X_scaled)

# Post-processing

pred_approval_prob = pred_task1[:, 0]

pred_approved = (pred_approval_prob >= 0.5).astype(int)

pred_credit_limit = np.minimum(np.maximum(pred_task1[:, 1], 0), max_credit_limit)

pred_interest_rate = np.minimum(np.maximum(pred_task1[:, 2], 0), max_interest_rate)

pred_default_risk = pred_task1[:, 3]

pred_repayment = pred_task1[:, 4]

pred_utilization_rate = np.clip(pred_task1[:, 5], 0, 1)

# Calculate predicted profit

avg_daily_balance = pred_credit_limit * pred_utilization_rate

daily_interest_rate = pred_interest_rate / 365

predicted_interest = avg_daily_balance * daily_interest_rate * days_in_lookahead

predicted_revenue = predicted_interest * pred_repayment

predicted_cost = pred_credit_limit * pred_default_risk

predicted_profit = (pred_approved * (predicted_revenue - predicted_cost)).flatten()

# Compare with actual profit

actual_profit = y_profit.flatten()

profit_diff = predicted_profit - actual_profit

# Display the results

pred_task1_df = pd.DataFrame({

"approval prob": pred_approval_prob,

"approved": pred_approved,

"credit limit": pred_credit_limit,

"interest rate": pred_interest_rate,

"default risk": pred_default_risk,

"repayment prob": pred_repayment,

"utilization rate": pred_utilization_rate,

"predicted profit": predicted_profit,

"actual profit": actual_profit,

"profit difference": profit_diff

})

# print(pred_task1_df.head(4))

print(f"New Profit: {sum(pred_task1_df['predicted profit']):,.2f}")

print(f"Actual Profit: {sum(pred_task1_df['actual profit']):,.2f}")

print(f"Can make {sum(pred_task1_df['profit difference']):,.2f} more")

32/32 [==============================] - 0s 1ms/step

New Profit: 0.00

Actual Profit: -10,231,358.18

Can make 10,231,358.18 more

Credit Approval Prediction Evaluation#

Credit approval is a binary classification task. Here, we’ll calculate metrics like accuracy, precision, recall, and the AUC-ROC.

from sklearn.metrics import accuracy_score, precision_score, recall_score, f1_score, roc_auc_score, confusion_matrix

# Predicted and actual approval values

pred_approved = (pred_approval_prob >= 0.5).astype(int) # Convert probabilities to binary approvals

actual_approved = y_approved.flatten()

# Calculate classification metrics

accuracy = accuracy_score(actual_approved, pred_approved)

precision = precision_score(actual_approved, pred_approved)

recall = recall_score(actual_approved, pred_approved)

f1 = f1_score(actual_approved, pred_approved)

roc_auc = roc_auc_score(actual_approved, pred_approval_prob) # Use probabilities for AUC-ROC

# Confusion matrix

conf_matrix = confusion_matrix(actual_approved, pred_approved)

# Display the results

print(f"Credit Approval Prediction - Evaluation Metrics:")

print(f"Accuracy: {accuracy:.4f}")

print(f"Precision: {precision:.4f}")

print(f"Recall: {recall:.4f}")

print(f"F1-Score: {f1:.4f}")

print(f"AUC-ROC: {roc_auc:.4f}")

print(f"Confusion Matrix:\n{conf_matrix}")

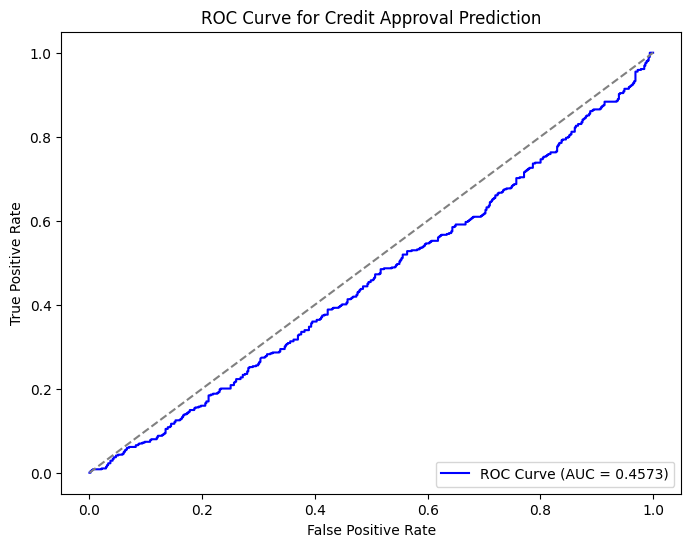

# Visualize the ROC Curve for Approval Prediction

# The ROC curve helps visualize the trade-off between the true positive rate and false positive rate at different thresholds.

import matplotlib.pyplot as plt

from sklearn.metrics import roc_curve

# Calculate ROC curve

fpr, tpr, _ = roc_curve(actual_approved, pred_approval_prob)

# Plot the ROC curve

plt.figure(figsize=(8, 6))

plt.plot(fpr, tpr, color='blue', label=f'ROC Curve (AUC = {roc_auc:.4f})')

plt.plot([0, 1], [0, 1], color='gray', linestyle='--')

plt.title('ROC Curve for Credit Approval Prediction')

plt.xlabel('False Positive Rate')

plt.ylabel('True Positive Rate')

plt.legend(loc='lower right')

plt.show()

Credit Approval Prediction - Evaluation Metrics:

Accuracy: 0.4670

Precision: 0.4704

Recall: 0.7157

F1-Score: 0.5677

AUC-ROC: 0.4573

Confusion Matrix:

[[117 394]

[139 350]]

Credit Limit Prediction Evaluation#

Credit limit is a continuous variable, so we’ll use regression metrics like Mean Absolute Error (MAE), Mean Squared Error (MSE), and R-squared (R²) to evaluate the predictions.

from sklearn.metrics import mean_absolute_error, mean_squared_error, r2_score

# Predicted and actual credit limits

actual_credit_limit = y_credit_limit.flatten()

# Calculate regression metrics

mae_credit_limit = mean_absolute_error(actual_credit_limit, pred_credit_limit)

mse_credit_limit = mean_squared_error(actual_credit_limit, pred_credit_limit)

r2_credit_limit = r2_score(actual_credit_limit, pred_credit_limit)

# Display the results

print(f"Credit Limit Prediction - Evaluation Metrics:")

print(f"MAE: {mae_credit_limit:.2f}")

print(f"MSE: {mse_credit_limit:.2f}")

print(f"R-squared: {r2_credit_limit:.4f}")

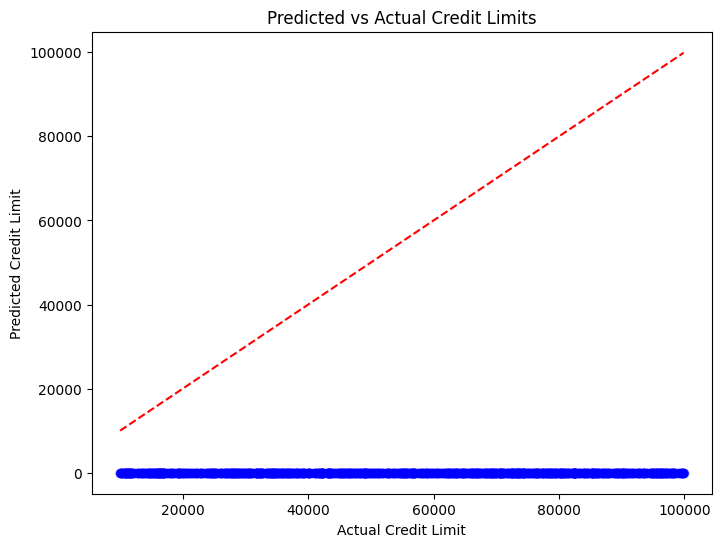

# Visualize Credit Limit Predictions vs Actual Values

# It’s helpful to visualize how the predicted values compare to the actual credit limits. A scatter plot with a diagonal line (representing perfect prediction) can show how well the model performed.

plt.figure(figsize=(8, 6))

plt.scatter(actual_credit_limit, pred_credit_limit, color='blue', alpha=0.5)

plt.plot([min(actual_credit_limit), max(actual_credit_limit)], [min(actual_credit_limit), max(actual_credit_limit)], color='red', linestyle='--')

plt.title('Predicted vs Actual Credit Limits')

plt.xlabel('Actual Credit Limit')

plt.ylabel('Predicted Credit Limit')

plt.show()

Credit Limit Prediction - Evaluation Metrics:

MAE: 55126.36

MSE: 3716174896.90

R-squared: -4.4871

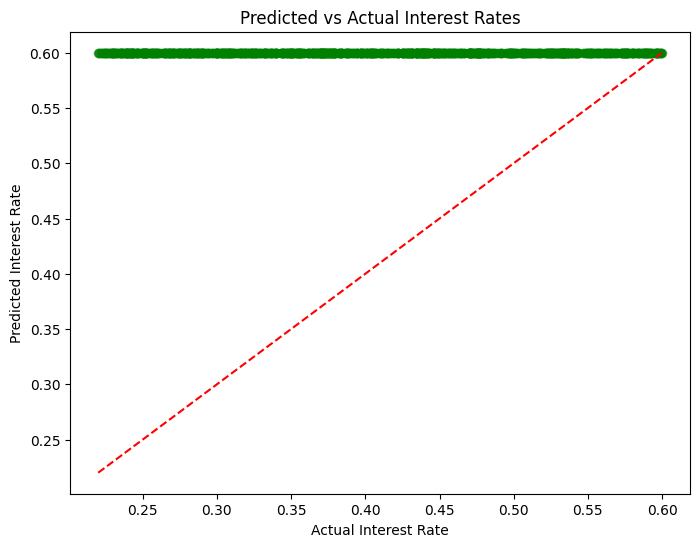

Interest Rate Prediction Evaluation#

Interest rate is also a continuous prediction, so we’ll use the same regression metrics as for credit limit (MAE, MSE, and R²).

# Predicted and actual interest rates

actual_interest_rate = y_interest_rate.flatten()

# Calculate regression metrics for interest rate

mae_interest_rate = mean_absolute_error(actual_interest_rate, pred_interest_rate)

mse_interest_rate = mean_squared_error(actual_interest_rate, pred_interest_rate)

r2_interest_rate = r2_score(actual_interest_rate, pred_interest_rate)

# Display the results

print(f"Interest Rate Prediction - Evaluation Metrics:")

print(f"MAE: {mae_interest_rate:.4f}")

print(f"MSE: {mse_interest_rate:.4f}")

print(f"R-squared: {r2_interest_rate:.4f}")

plt.figure(figsize=(8, 6))

plt.scatter(actual_interest_rate, pred_interest_rate, color='green', alpha=0.5)

plt.plot([min(actual_interest_rate), max(actual_interest_rate)], [min(actual_interest_rate), max(actual_interest_rate)], color='red', linestyle='--')

plt.title('Predicted vs Actual Interest Rates')

plt.xlabel('Actual Interest Rate')

plt.ylabel('Predicted Interest Rate')

plt.show()

Interest Rate Prediction - Evaluation Metrics:

MAE: 0.1957

MSE: 0.0501

R-squared: -3.2370

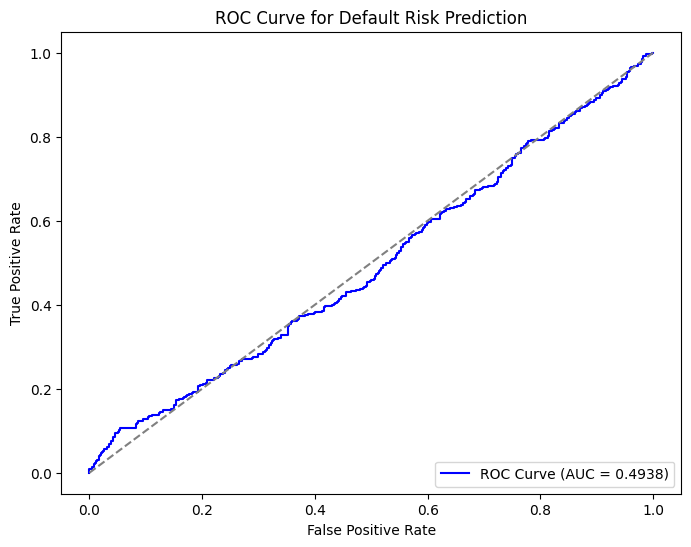

Default Risk Prediction Evaluation#

Default risk prediction is a classification task. We can evaluate it using the same metrics as for credit approval: accuracy, precision, recall, F1-score, and AUC-ROC.

# Predicted and actual default risk values

actual_default_risk = y_defaulted.flatten()

# Calculate classification metrics for default risk

accuracy_default = accuracy_score(actual_default_risk, (pred_default_risk >= 0.5).astype(int))

precision_default = precision_score(actual_default_risk, (pred_default_risk >= 0.5).astype(int))

recall_default = recall_score(actual_default_risk, (pred_default_risk >= 0.5).astype(int))

f1_default = f1_score(actual_default_risk, (pred_default_risk >= 0.5).astype(int))

roc_auc_default = roc_auc_score(actual_default_risk, pred_default_risk)

# Display the results

print(f"Default Risk Prediction - Evaluation Metrics:")

print(f"Accuracy: {accuracy_default:.4f}")

print(f"Precision: {precision_default:.4f}")

print(f"Recall: {recall_default:.4f}")

print(f"F1-Score: {f1_default:.4f}")

print(f"AUC-ROC: {roc_auc_default:.4f}")

# Calculate ROC curve for default risk

fpr_default, tpr_default, _ = roc_curve(actual_default_risk, pred_default_risk)

# Plot the ROC curve

plt.figure(figsize=(8, 6))

plt.plot(fpr_default, tpr_default, color='blue', label=f'ROC Curve (AUC = {roc_auc_default:.4f})')

plt.plot([0, 1], [0, 1], color='gray', linestyle='--')

plt.title('ROC Curve for Default Risk Prediction')

plt.xlabel('False Positive Rate')

plt.ylabel('True Positive Rate')

plt.legend(loc='lower right')

plt.show()

Default Risk Prediction - Evaluation Metrics:

Accuracy: 0.4950

Precision: 0.0000

Recall: 0.0000

F1-Score: 0.0000

AUC-ROC: 0.4938

C:\ProgramData\anaconda3\envs\mlpy\lib\site-packages\sklearn\metrics\_classification.py:1334: UndefinedMetricWarning: Precision is ill-defined and being set to 0.0 due to no predicted samples. Use `zero_division` parameter to control this behavior.

_warn_prf(average, modifier, msg_start, len(result))

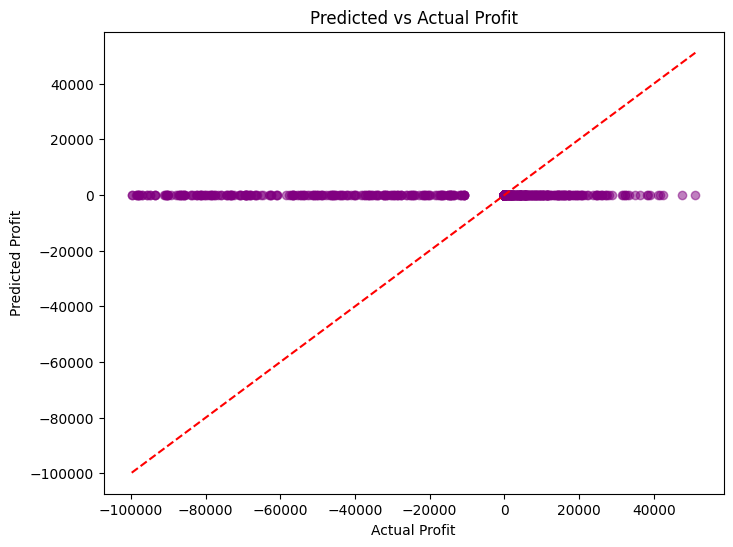

Profit Evaluation#

Finally, the primary business objective is to maximize profit, so evaluating how well the model predicts profits is crucial.

We can compare the predicted profit with the actual profit using metrics like MAE, MSE, and R². Additionally, visualizing the predicted and actual profits can give further insights.

# Actual profit

actual_profit = y_profit.flatten()

# Calculate regression metrics for profit

mae_profit = mean_absolute_error(actual_profit, predicted_profit)

mse_profit = mean_squared_error(actual_profit, predicted_profit)

r2_profit = r2_score(actual_profit, predicted_profit)

# Display the results

print(f"Profit Prediction - Evaluation Metrics:")

print(f"MAE: {mae_profit:.2f}")

print(f"MSE: {mse_profit:.2f}")

print(f"R-squared: {r2_profit:.4f}")

plt.figure(figsize=(8, 6))

plt.scatter(actual_profit, predicted_profit, color='purple', alpha=0.5)

plt.plot([min(actual_profit), max(actual_profit)], [min(actual_profit), max(actual_profit)], color='red', linestyle='--')

plt.title('Predicted vs Actual Profit')

plt.xlabel('Actual Profit')

plt.ylabel('Predicted Profit')

plt.show()

Profit Prediction - Evaluation Metrics:

MAE: 15558.13

MSE: 912406517.33

R-squared: -0.1296

Out-of-Sample Testing (Holdout Set or Deployment)#

# Assuming X_test and y_test are your holdout test sets

test_predictions = model_task1.predict(X_test)

# Evaluate the model on the test set

test_mse = mean_squared_error(y_test, test_predictions)

print(f"Test MSE: {test_mse:.2f}")

Other considerations include:

Cross-validation: Ensures model performance is not overly optimistic and generalizes well.

Hyperparameter tuning: Finds the best configuration for your model to improve its predictive accuracy.

Feature importance: Helps identify which features drive the model’s predictions, improving explainability and interpretability.

Handling Class Imbalance

Regularization: Reduces overfitting and improves generalization to unseen data.

Explainability: Provides transparency, which is especially important in regulatory environments.

Counterfactual Analysis

Profit strategies: Ensures that business objectives (like profit maximization) are being met by the model.

Consider modifying the profit function: could include the onboarding fees (e.g., marketing and promotional expenses) in cost